Advancing the U.S. Bioindustrial Production Sector

Summary

The bioindustrial production of chemicals and other goods is a critical sector of the U.S. bioeconomy. However, the sector faces challenges such as drawn-out research and development timelines, low profit margins, the requirements to produce and sell product in vast quantities over long periods of time, and barriers to accessing scale-up capacity. Companies can find it challenging to rapidly exchange helpful knowledge, attract early-stage investors, access pilot-scale infrastructure to generate evidence that forecasts cost-effective production at scale, and obtain the financing to build or access domestic commercial-scale bioproduction, biomanufacturing, and downstream bioprocessing infrastructure and facilities.

The federal government has already recognized the need to take action to sustain and extend U.S. leadership in biotech and biomanufacturing. The recent Executive Order on advancing the U.S. bioeconomy and relevant provisions in the CHIPS and Science Law and the Inflation Reduction Law have put forward high aspirations, as well some funding, that could help stimulate the biotech and biomanufacturing ecosystem.

The U.S. government should create a Bio for America Program Office (BAPO) at the National Institute for Standards and Technology (NIST) to house a suite of initiatives that would lead to the creation of more well-paying U.S.-based biomanufacturing jobs, spur economic growth and development in areas of the country that haven’t historically benefited from biotech or biomanufacturing, and ensure more resilient U.S. supply chains, the more sustainable production of chemicals and other goods, and enhanced U.S. competitiveness.

Challenge and Opportunity

The bioeconomy—the part of the economy driven by the life sciences and biotech, and enabled by engineering, computing, and information science—has the potential to revolutionize human health, climate and energy, food security and sustainability, and supply chain stability, as well as support economic growth and well-paying jobs across the country. Indeed, the sector has already produced many breakthroughs, such as mRNA vaccines that help counter the devastating impacts of COVID-19 and genetically engineered microbes that provide nutrients to crops without the pollution associated with traditional fertilizers. Valued at over $950 billion, the U.S. bioeconomy accounts for more than five percent of the U.S. gross domestic product—more than the contribution from the construction industry and on par with the information sector.

However, without sufficient federal support and coordination, the U.S. risks ceding economic, national security, and societal benefits provided by a strong bioeconomy to competitors that are implementing cohesive strategies to advance their bioeconomies. For example, China aims to dominate the 21st-century bioeconomy and has prioritized the growth of its bioeconomy in its five-year plans. From 2016 to July 2021, the market value of publicly listed biopharmaceutical innovators from China increased approximately 127-fold across several major stock exchanges, to more than $380 billion, with biotechnology companies accounting for more than 47 percent of that valuation.

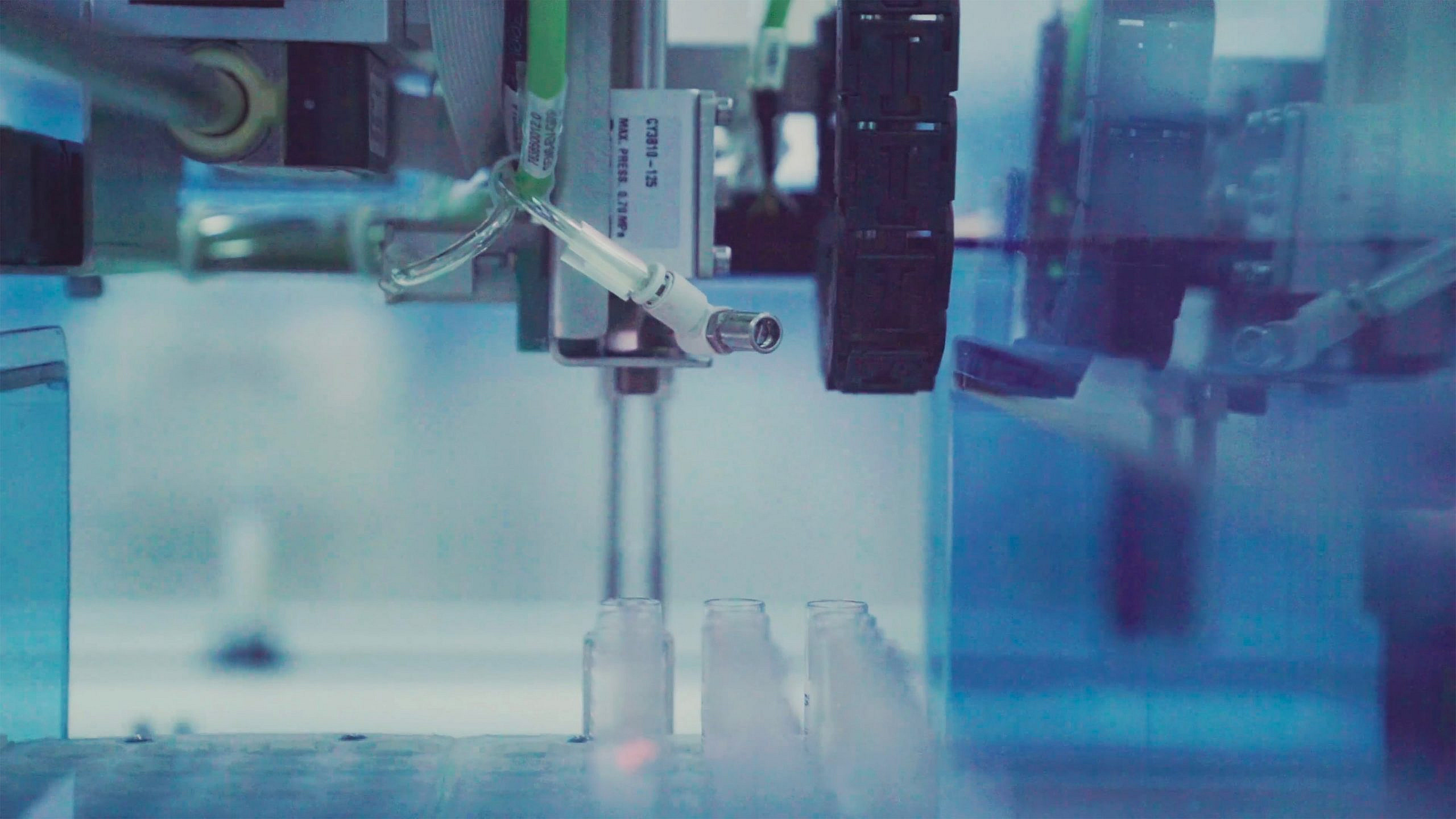

Bioindustrial manufacturing (nonpharmaceutical) is a critical segment of the bioeconomy but faces low profit margins combined with the need to produce and sell product in vast quantities over long timelines. It is challenging for companies to translate research and development into commercially viable efforts and attract investors to finance access to or construction of domestic bioproduction, biomanufacturing, and downstream bioprocessing infrastructure and facilities such as fermentation tanks and bioreactors. Furthermore, many biotech and synthetic biology companies face difficulty acquiring capital for scale-up, whether that requires building custom demonstration- or commercial-scale infrastructure, contracting with fee-for-service bioproduction organizations to outsource manufacturing in external facilities, or retooling existing equipment.

All this has the potential to lead to yet more instances of “designed in America, made elsewhere”: microbes that are engineered by U.S. companies to fabricate chemicals or other products could end up being used to produce at commercial scale abroad, which is not a recipe for economic growth and improving quality of life for residents of the U.S. Domestic manufacturers should be executing bioindustrial production so that more well-paying jobs are accessible in the U.S., with the added benefits of contributing to a more stable supply chain, which bolsters U.S. national and economic security.

The federal government has recognized the need for U.S. leadership in biotech and biomanufacturing: the recent Executive Order on advancing the U.S. bioeconomy and relevant provisions in the CHIPS and Science Law and the Inflation Reduction Act (IRA) provide high-level aspirations and some actual dollars to bolster the biotech and biomanufacturing ecosystem. Indeed, some funds appropriated in the IRA could be used to meet biomanufacturing goals set in the CHIPS and Science Law and EO.

To reach its full potential, bioindustrial manufacturing requires additional support at various levels and may need as much as hundreds of billions of dollars in capital. There is an opportunity for the U.S. government to be intentional about accelerating the growth of the bioindustrial manufacturing sector, and reaping the economic, national security, and societal benefits that would come with it.

Public-private partnerships aimed at providing resources and capital for experimental development at early-stage companies, as well as bioindustrial production scale-up and commercialization projects that are techno-economically sound, would be a strong signal that the federal government is serious about leveraging bioindusty to meet human health, climate and energy, food security and sustainability, and supply chain stability needs, as well as support economic growth and well-paying jobs. Many of the investments by the U.S. taxpayers would be matched and multiplied by investments from nongovernment sources, amplifying the impact, and generating high return on investment for Americans in the form of well-paying jobs, breakthrough products, and more stable supply chains. Furthermore, the investment would show that the U.S. is committed to leveraging advanced manufacturing to raise quality of life for Americans and retain leadership in biotech and biomanufacturing.

Plan of Action

This plan focuses on four initiatives that address specific challenge points:

- A Bioindustrial Production Consortium (BPC), which would coordinate precompetitive efforts to address the measurements, tools, and standards needed for advancing both research and commercial products in the bioindustrial production space and would also collaborate with BioMADE, industry, government scientists, and other stakeholders.

- BAPO Ventures, which would coordinate both existing and new appropriations to seed a nonprofit partnership manager to launch a U.S. Bioindustrial Production Investment Portfolio that crowds-in additional capital from nonfederal government sources and makes calculated investments in early-stage, domestic bioindustrial production companies that demonstrate credible pathways to product commercialization.

- The Bioindustrial Production Scale-up Infrastructure Group (BPSIG), which would work with both the interagency and nonfederal government partners to conduct a comprehensive analysis of the U.S. bioindustrial production pilot- and intermediate-scale infrastructure landscape to develop a precision strategy for moving forward on domestic bioindustrial production scale-up capacity.

- A Bioindustrial Production Loan Program Office, which would rely on partners such as the U.S. Small Business Administration to provide debt financing for techno-economically sound, domestic demonstration- or commercial-scale bioindustrial production infrastructure projects

The proposed initiatives could all be housed in a new office at NIST called the Bio for America Program Office (BAPO), which would collaborate closely with the Office of the Secretary of Commerce and the Under Secretary of Commerce for Standards and Technology, as well as additional government and nongovernmental stakeholders as appropriate. NIST would be an effective home for the BAPO given that it harbors cross-disciplinary expertise in engineering and the physical, information, chemical, and biological sciences; is a nonregulatory agency of the U.S. Department of Commerce, whose mission it is “to drive U.S. economic competitiveness, strengthen domestic industry, and spur the growth of quality jobs in all communities across the country”; and serves as a neutral convener for industry consortia, standards development organizations, federal labs, universities, public workshops, and interlaboratory comparability testing.

Bioindustrial Production Precompetitive Consortium

NIST should establish a Consortium, coordinated out of BAPO, to address the measurements, tools, and standards needed to advance both research and commercial bioindustrial products. The Consortium would convene industry, academia, and government to identify and address measurement, tool, and standards needs; enable members to work with NIST to develop those solutions and standards; leverage NIST expertise; and collaborate with related programs at other federal agencies. The Consortium could rapidly develop relationships with organizations such as the Bioindustrial Manufacturing and Design Ecosystem (BioMADE, a Manufacturing Innovation Institute that is part of the Manufacturing USA network), the Engineering Biology Research Consortium (EBRC), SynBioBeta, the Alternative Fuels & Chemicals Coalition (AFCC), the Synthetic Biology Coalition, the Joint BioEnergy Institute, and the Advanced Biofuels and Bioproducts Process Development Unit at Lawrence Berkeley National Laboratory, and the National Renewable Energy Laboratory’s pilot-scale Integrated Biorefinery Research Facility. It would also be useful to communicate with efforts in the biopharmaceutical space such as the Biomedical Advanced Research and Development Authority (BARDA) and the National Institute for Innovation in Manufacturing Biopharmaceuticals.

The benefits to members would include access to a neutral forum for addressing precompetitive needs; participation in the development of experimental benchmarks, guidelines, and terminology; access to tools developed by the consortium ahead of public release; and institutional representation on the consortium steering committee. Members would contribute an annual fee of, for example, $20,000 or in-kind support of equivalent value, as well as sign a Cooperative Research and Development Agreement.

Congress should initially appropriate $20 million over five years to support the Consortium’s activities, and the Consortium could launch by putting forward a Notice of Consortium establishment and letter of interest form.

U.S. Bioindustrial Production Investment Portfolio

Early-stage companies are the engine for U.S. job creation, regional economic development, and technological innovation. A more consistent, yet scrupulous, source of funding for nascent companies in the bioindustrial production space would be catalytic. Using the BARDA Ventures-Global Health Investment Corporation (GHIC) Global Health Security Portfolio public-private partnership as a model, the U.S. government, coordinating both existing and new appropriations via BAPO Ventures, should seed a nonprofit partnership manager to launch a U.S. Bioindustrial Production Investment Portfolio. The portfolio would crowd-in additional capital and invest in early-stage, domestic bioindustrial production companies that share sound metrics and credible techno-economic analyses that they are on the path to product commercialization and profitability.

The portfolio’s nonprofit partnership manager should be empowered to crowd-in capital using return augmentation and risk mitigation incentives as they see fit. Measures that a venture fund could take to incentivize coinvestment could include but are not limited to:

- Taking a concessionary position in the waterfall (return calculation) to allow larger returns for coinvestors

- Capping their own returns to enable greater returns for coinvestors

- Implementing a convertible debt plan that would only reward a bioproduction company’s management team with equity after reaching key milestones

- Providing an opportunity for discounted buyout by other investors in future rounds

- In select cases, working with the federal government to design market-shaping mechanisms such as advance market commitments to guarantee purchase of a bioproduction company’s spec-meeting product

Launching a U.S. Bioindustrial Production Investment Portfolio requires the following four steps.

1. Both existing and newly appropriated federal funds should be used to seed investments in the U.S. Bioindustrial Production Investment Portfolio.

Existing appropriations: Appropriations have already been made to some federal agencies through the IRA and other vehicles that could be used to seed the portfolio. BAPO Ventures should coordinate with the interagency, and agencies with available funds could contribute to directly seeding the portfolio. Some examples of existing funds to coordinate include:

- 2% of the $1 billion the Department of Defense (DoD) has allocated for investing in emerging biomanufacturing capabilities. As necessary, monies from these appropriations could be routed directly from DoD to a specific fund, or funds, within the portfolio that would only invest in qualified projects; any return expectations would need to be structured appropriately.

- 6% of the $5 billion the IRA recently appropriated to the Department of Energy (DOE) Loan Programs Office new Energy Infrastructure Reinvestment Financing Program. This appropriation is “to be leveraged for up to $250 billion in commitment authority for loan guarantees (including refinancing) of eligible projects,” and loans can be used to retool or repurpose energy infrastructure toward bioindustrial production or to use biotech to reduce pollution from operating energy infrastructure. Monies from this program could be loaned to a specific fund within the portfolio that only invests in qualified projects. The return expectations would need to be structured appropriately since there would be no return for many months and so no monies to make loan payments, and then ideally a big multiple of invested capital in the long term. The loan guarantees to the portfolio could be structured as debt with balloon payments, convertible debt, or participating preference, which essentially acts like debt but is structured as equity. The Small Business Administration Office of Investment and Innovation could be consulted to assist with this process.

- 8% of the $5.8 billion the IRA recently appropriated to the DOE Office of Clean Energy Demonstrations new Advanced Industrial Facilities Deployment Program. This appropriation provides financial assistance for incorporating advanced industrial technologies, such as biotech and bioindustrial production, to reduce emissions from making goods like steel, paper, concrete, and chemicals. Similar to the above, monies from this program could be routed to a specific fund within the portfolio that only invests in qualified projects.

New appropriations: Congress should appropriate $500 million in new funding for BAPO Ventures over five years to support BAPO Ventures personnel and operations and augment the portfolio. These funds would be critical since they could be applied for all-purpose venture capital investments in early-stage bioindustrial production companies. Congress should also grant BAPO Ventures, as well as other agencies or programs, any authority needed to transfer funds to the portfolio for these purposes.

2. Identify the nonprofit partnership manager.

BAPO Ventures should solicit proposals for an existing nonprofit partner to manage the U.S. Bioindustrial Production Investment Portfolio. Selection should be based on demonstrated track record of experience with and successful venture investments in bioindustrial manufacturing or a closely related space. Potential nonprofit partners include Breakthrough Energy Catalyst or America’s Frontier Fund. GHIC should also be consulted.

3. Transfer funds from the appropriate U.S. government programs to funds within the portfolio and support the nonprofit partnership manager in crowding-in additional capital.

The nonprofit partnership manager will recruit capital from nonfederal government sources into the portfolio’s different funds with the aim of matching and/or exceeding the dedicated public funds to generate a multiplier effect and access even more capital. Capital from investors willing to take on risk equatable to venture capital would be the most viable targets.

4. The nonprofit partnership manager will use the portfolio’s funds to invest in U.S. early-stage bioindustrial production companies on the basis of sound techno-economic analyses and robust metrics.

The nonprofit partnership manager would invest in bioindustrial production companies that commit to hiring and manufacturing domestically and making products useful to Americans and the country, on the basis of robust techno-economic analyses of the companies’ commercial potential, and generate returns on investments. BAPO Ventures, as well as NIST writ large, would be accessible for technical assistance, if necessary. The nonprofit partnership manager would structure investments with co-funding from additional nonfederal government investors. As this public-private partnership generates investment returns, proceeds from the BAPO Ventures funding will be returned to the portfolio and its funds for reinvestment and sustainment of BAPO Ventures. If this evergreen fund begins to compete with, rather than incentivize, private market funding, or otherwise begins to be unproductive, the fund should be tapered off and/or sunset.

Bioindustrial Production Scale-up Infrastructure Group

It is critical for early-stage bioindustrial production companies to gather evidence that their production processes have the potential to be commercially viable at scale—or not. To learn this, companies need access to pilot- and intermediate-scale bioindustrial production infrastructure like fermenters and bioreactors, as well as modern downstream bioprocessing equipment. The BAPO should house a Bioindustrial Production Scale-up Infrastructure Group (BPSIG). which, as an initial step, would work with both the interagency and nonfederal government partners to conduct a comprehensive analysis of the U.S. bioindustrial production pilot- and intermediate-scale infrastructure landscape with the aim of informing a precision strategy for most effectively leveraging federal resources.

The BPSIG would aim to complete the landscape analysis in three months, seeking to understand deficiencies in capacities such as the different volumes of fermenters and bioreactors that are accessible (and the costs associated with their use) and modular downstream bioprocessing equipment accessibility. They should also identify existing facilities that have accessible capacity, such as corporations’ sites where capacity might be rented, toll facilities, or facilities that could be retooled or rehabilitated to provide the necessary pilot-scale capacity. BPSIG should engage with organizations such as Capacitor, the Bioprocess to Product Network, Royal DSM, DuPont, Cargill, BioMADE, Battelle, MITRE, and the Advanced Biofuels and Bioproducts Process Development Unit at Lawrence Berkeley National Laboratory when performing this evaluation.

If the assessment concludes that retooling existing sites or building new pilot- or intermediate-scale infrastructure is necessary, and that government support would be catalytic, some funds would already be available via existing appropriations, and new appropriations might also be necessary. Appropriations have already been made to some federal agencies through the IRA and other vehicles that could be coordinated by the BPSIG. BPSIG should coordinate with the interagency, and agencies with available funds could contribute directly to building the network. Existing funds to leverage include:

- The $1 billion the DoD has allocated for bioindustrial domestic manufacturing infrastructure. As appropriate, monies from this allocation could be routed directly from DoD to pilot-scale network projects that are within those monies’ purview.

- The $5 billion the IRA recently appropriated to the DOE Loan Programs Office new Energy Infrastructure Reinvestment Financing Program. This appropriation is “to be leveraged for up to $250 billion in commitment authority for loan guarantees (including refinancing) of eligible projects”; loans can be used to retool or repurpose energy infrastructure toward bioindustrial production or reduce pollution from operating energy infrastructure using biotech.

Additionally, Congress may need to make appropriations directly to BPSIG, which BPSIG could then allocate to other federal financing programs for retooling or building any additional pilot- or intermediate-scale bioindustrial production infrastructure projects outside the scope of existing pools of already-appropriated funds.

Bioindustrial Production Loan Program Office

To ensure techno-economically sound bioindustrial production companies can secure financing for demonstration- or commercial-scale infrastructure and equipment needs, Congress should enable an initiative within BAPO called the Bioindustrial Production Loan Programs Office (BPLPO) that replicates and improves the DOE LPO model. The BPLPO would be tailored to the bioindustrial production segment, without agencies’ science or technology mission area constraints (for instance, energy), offering flexible debt instruments and supporting large-scale projects. For example, assistance in the form of loan guarantees would help underwrite debt associated with launching bioproduction plants.

Coordination with DOE LPO, DOE Office of Clean Energy Demonstrations, the U.S. Small Business Association, the relevant U.S. Department of Agriculture loan programs, and other government agencies and offices would be key to avoid duplicating efforts and to incorporate lessons learned and best practices from existing efforts. Congress should appropriate an initial $5 billion for the BPLPO, authorizing the program for an initial 10 years.

Conclusion

Launching a suite of public-private partnerships to advance domestic bioproduction would create more well-paying biomanufacturing jobs in the U.S., expand economic opportunity across the country by spreading the biotech and biomanufacturing footprint into nontraditional areas, produce more high-quality chemicals and goods in the U.S., and help meet national and economic security needs, such as strengthened supply chains and more sustainable production methods.

BARDA, situated within the Department of Health and Human Services Office of the Assistant Secretary for Preparedness and Response, launched BARDA Ventures in June 2021 to “accelerate development and commercialization of technologies and medical products needed to respond to or prevent public health emergencies, such as pandemics, and other health security threats.” BARDA has provided the nonprofit organization GHIC tens of millions of dollars. GHIC launched and manages a global health security fund with matching capital from other investors. This partnership allows direct linkage with the investment community and establishes sustained and long-term efforts to identify, nurture, and commercialize technologies that aid the U.S. in responding effectively to future health security threats.

Yes. The BARDA-GHIC model can be considered when there is underinvestment from the capital markets in a particular early-stage commercial area.

Some funds have already been appropriated to DoD and DOE that could be used to advance U.S. bioindustrial production. DoD and DOE are both stakeholders in bioindustrial manufacturing whose missions would benefit from virtually any domestic bioindustrial manufacturing efforts.

Capital from strategic investors, venture investors with long-term outlooks, and private equity, with growth equity of particular interest, could be targeted. Examples of strategic investors that could be pursued include IndianOil Corp, Petronas, Brookfield, or BASF. Venture investors with longer-term outlook funds like Breakthrough Energy Catalyst would also be candidates to pursue to recruit capital.

The scale-up and commercialization of some bioindustrial production capabilities can be capital intensive; however, standing-up bioproduction facilities can cost two to 2,000 times less than chemical facilities, and operating expenses for a bioproduction facility are relatively low, making return on capital more attractive to capital markets. It’s likely that investments’ returns should be expected to be long-term in nature. Investments now could help some bioindustrial production operations reach profitability by the mid- to late 2020s, with positive returns on investments likely. In addition to acquiring equity in bioindustrial production companies, some investors may contribute to commercializing the bioindustrial production of those operations’ chemicals or other goods in their regions of influence, etc.

Potential regional targets include Suffolk, Massachusetts, and Albany, New York, in the Northeast; Warren, Ohio, Johnson, Kansas, and Porter, Indiana, in the Midwest; Denton, Texas, Wake, North Carolina, and Canadian, Oklahoma, in the South; and Yavapai, Arizona, and Honolulu, Hawaii, in the West.

In the quest for sustainable energy and materials, biomass emerges as a key player, bridging the gap between the energy sector and the burgeoning U.S. and regional bioeconomies.

In the last decade, the U.S. has made significant investments to address the wildfire crisis, including the historic investments in hazardous fuels reduction through the IRA and IIJA.

The widespread adoption of conservation agricultural practices to protect soils is key to ensuring food security and water quality for current and future generations in the United States.

Multiple bioeconomy-related programs were authorized through the bipartisan CHIPS & Science legislation but have yet to receive anywhere near their funding targets.